(Querbeet/iStockphoto)

(Querbeet/iStockphoto)Church taxes are sometimes cited as one of a number of reasons for the decline in levels of religious commitment in Western Europe. Indeed, with mandatory church taxes linked to church membership and many Christians in the region already inclined to leave their faith, the added cost of the tax may be yet another incentive for people to step away.

But, in general, those countries that have a mandatory church tax aren’t any less religious than nations that don’t have such a tax, according to an analysis of a new Pew Research Center survey of Western Europe.

Among the 15 Western European countries we surveyed, six have mandatory taxes for members of the largest churches to help finance their activities – Austria, Denmark, Finland, Germany, Sweden and Switzerland. While most registered Christians (and in some countries, members of other religious groups) in these countries are required to pay the tax, they have the option of not paying by deregistering from their church.

To gain a better understanding of the way people’s attitudes about religion are connected to church taxes, Pew Research Center asked adults in these 15 countries a number of questions commonly used to measure religious commitment. These questions include whether they believe in God and identify with a religious group, as well as how often they pray and attend worship services.

To gain a better understanding of the way people’s attitudes about religion are connected to church taxes, Pew Research Center asked adults in these 15 countries a number of questions commonly used to measure religious commitment. These questions include whether they believe in God and identify with a religious group, as well as how often they pray and attend worship services.

It turns out that on these questions, people in countries with a church tax give roughly similar answers to those in countries without a church tax. For example, respondents in countries with a mandatory church tax are no more or less likely than people surveyed in other Western European nations to say they believe in God. Among church tax countries, Austria has the highest share of people who say they believe in God (67%), while Sweden has the lowest (36%). That’s similar to the range in countries without a church tax, with Ireland at the high end (69%) and Belgium at the bottom (42%).

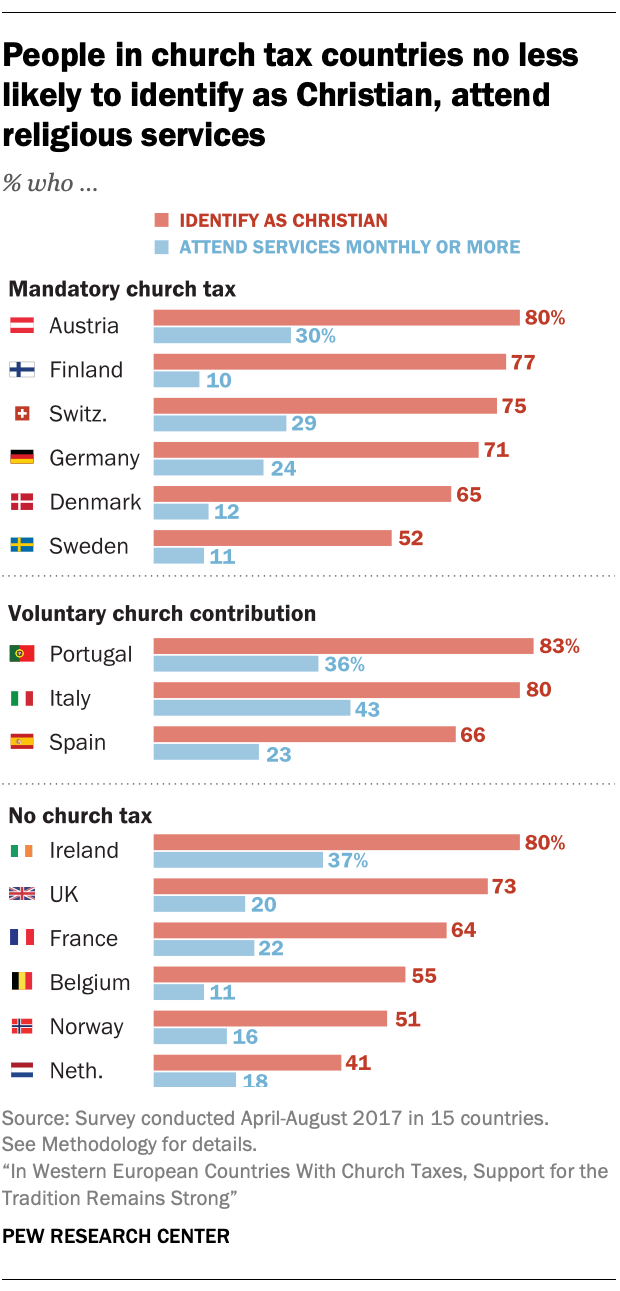

The same basic pattern holds true for levels of religious observance. A minority of adults in church tax countries say they attend worship services monthly or more, with the highest shares in Austria (30%), Switzerland (29%) and Germany (24%). That’s roughly in line with the share of people who say this in countries without a church tax, with Ireland (37%), France (22%) and the UK (20%) topping that list.

Regardless of whether they are formally registered with a church, people in countries with a mandatory church tax are more likely to self-identify as Christian than are people in Western European countries that do not have any church tax system. In four of the six countries with a mandatory church tax – Austria, Finland, Switzerland and Germany – roughly seven-in-ten or more adults identify as Christians. By contrast, in only two of the six countries surveyed that do not have a church tax – the UK and Ireland – does the share of Christians exceed seven-in-ten. And across Western Europe, the country with the smallest share of Christians (the Netherlands, 41%) does not have a church tax.

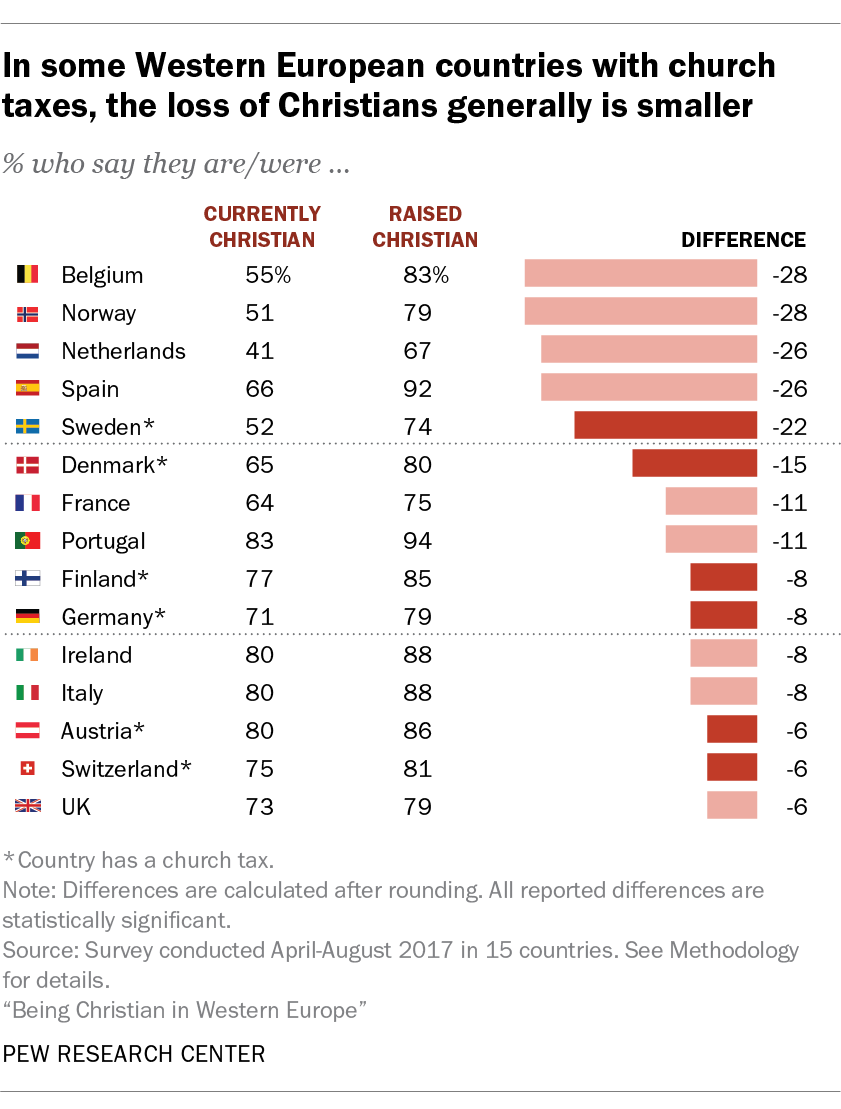

In some church tax countries, the share of people who identify as Christian generally is declining more slowly than in countries that do not have such taxes. In all 15 Western European countries surveyed, fewer people say they are currently Christian than say they were raised Christian. But the countries with the steepest drops in Christian identification – including Belgium, Norway and the Netherlands – do not have church taxes. And some of the countries with the smallest drops in Christian identification, such as Switzerland and Austria, do have a church tax.

In some church tax countries, the share of people who identify as Christian generally is declining more slowly than in countries that do not have such taxes. In all 15 Western European countries surveyed, fewer people say they are currently Christian than say they were raised Christian. But the countries with the steepest drops in Christian identification – including Belgium, Norway and the Netherlands – do not have church taxes. And some of the countries with the smallest drops in Christian identification, such as Switzerland and Austria, do have a church tax.

In addition to the six countries with a mandatory church tax, governments in three Western European nations – Italy, Portugal and Spain – allow taxpayers to allocate part of their income taxes to a religious group or charity, but don’t require it. In countries with these “voluntary” tax systems, people often show slightly higher levels of religious commitment than people in countries with a mandatory church tax. For instance, Italians and Portuguese are more likely to attend church (43% and 36%, respectively) than people in the six countries that have a mandatory church tax, such as Switzerland (29%) and Austria (30%).